2022

Good Podcast on Idaho School Bonds:

Have you seen your property tax valuations? They basically doubled from last year's valuation. How will that affect your property taxes? Significantly!

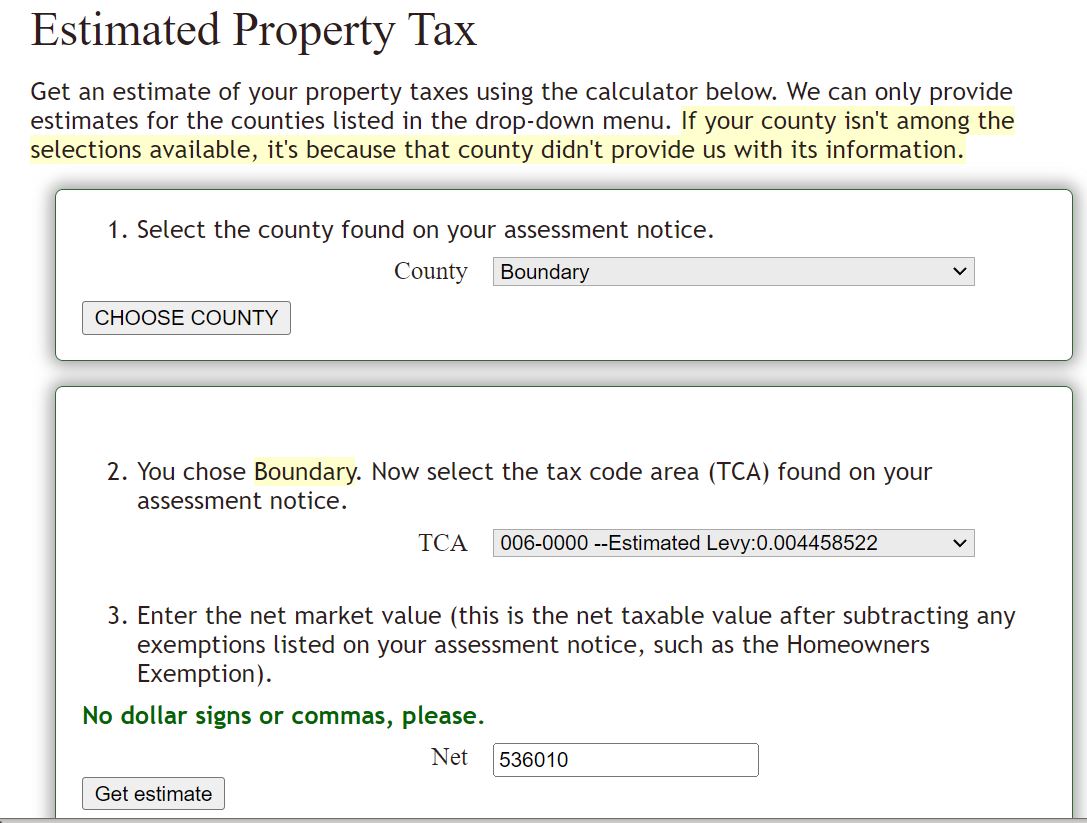

Check it out for yourself:

First, go to the State of Idaho's Estimated Property Tax Calculator: tax.idaho.gov/i-1072.cfm

Choose "Boundary County", then look at your new assessment paperwork and find the "Tax Code Area" a little down from the top right hand corner of the assessment. Use the drop down arrow to choose your Tax Code Area. Lastly, type in your net new home valuation, that's after your homeowner's exemption has been deducted. (For most of us, the homeowner's deduction is $125,000.) Then click, "Get Estimate".

Check it out for yourself:

First, go to the State of Idaho's Estimated Property Tax Calculator: tax.idaho.gov/i-1072.cfm

Choose "Boundary County", then look at your new assessment paperwork and find the "Tax Code Area" a little down from the top right hand corner of the assessment. Use the drop down arrow to choose your Tax Code Area. Lastly, type in your net new home valuation, that's after your homeowner's exemption has been deducted. (For most of us, the homeowner's deduction is $125,000.) Then click, "Get Estimate".

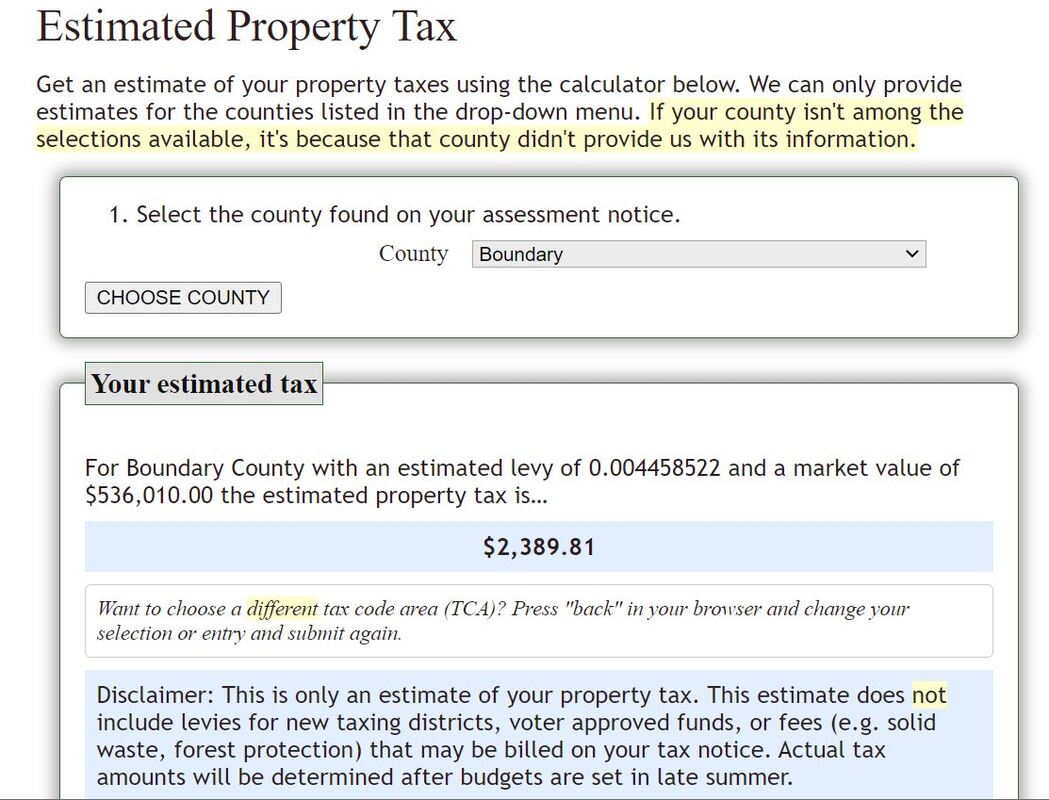

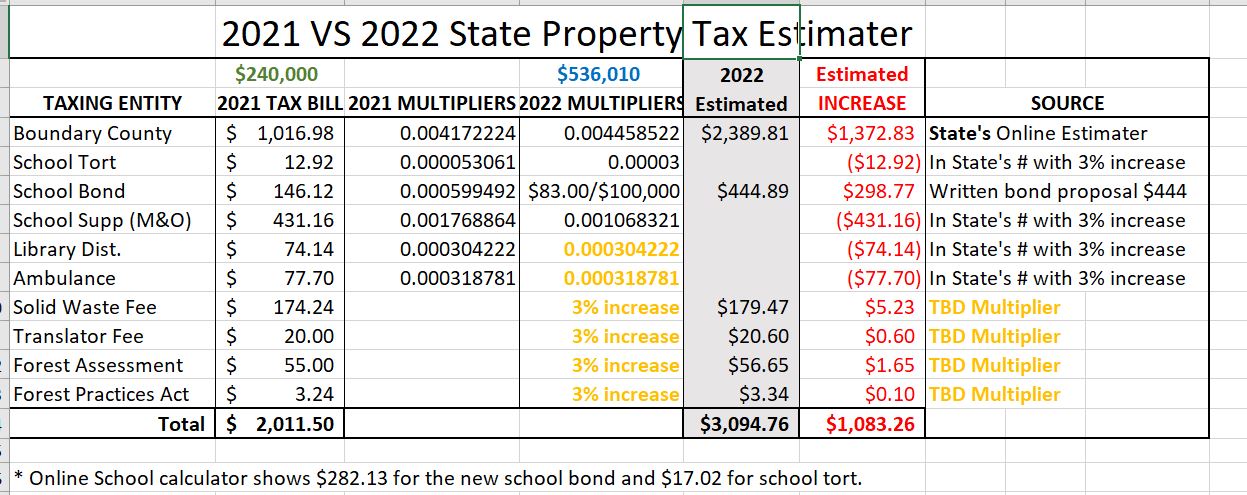

In this citizen's example, the state is estimating 2022/2023 property taxes to be $2,389.81. But this does not include any "fee" entities, such as solid waste, Translator Fee and the forest service fees. It also does not include the cost of the increase in the school bond. Last year's school bond tax was $146.12 for this property owner. Per the new school bond wording of $83.00 for every $100,000 of tax evaluation, you'd take your new, net property valuation, in their case it's $536,010 or $5.36 x $83k = $444.88. Now take the new, proposed school bond amount of $444.88 and deduct last year's school bond $146.12 and add that amount to the State's estimated tax. Realize last year's property tax valuation was $240,000 after homeowner's exemption was deducted. Yes! Their property valuation more than doubled.

Okay, now add in, with at least a 3% increase for solid waste, translator fee and forest fees from last year's tax bill. See this property owner's comparison from last year's taxes to the proposed amount for this year:

Okay, now add in, with at least a 3% increase for solid waste, translator fee and forest fees from last year's tax bill. See this property owner's comparison from last year's taxes to the proposed amount for this year:

Wow! A whopping $1,083.26 increase! Now you can see why we're saying your property taxes are skyrocketing!

School Bond Issue

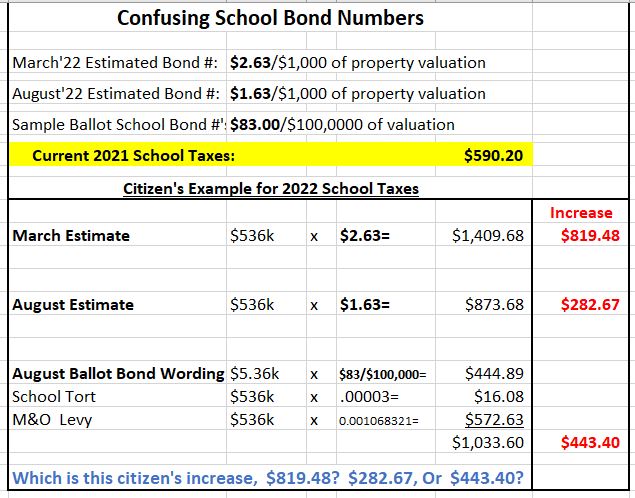

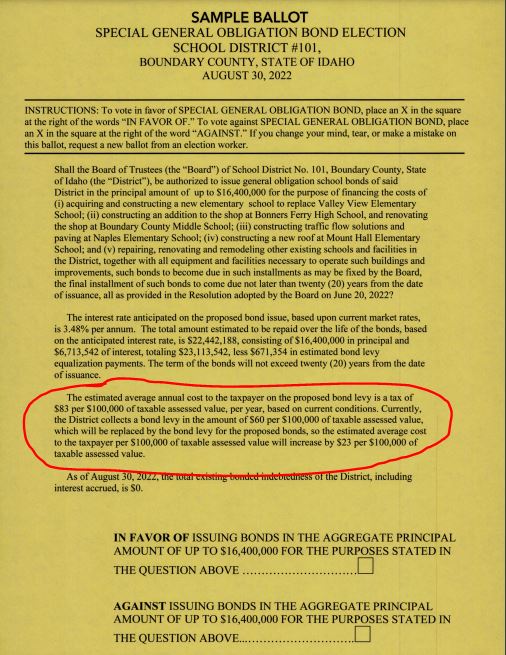

The $16.4 million School Bond vote is August 30th. To date, the school board has given us three different calculations to figure this tax increase if it were to pass.

1. Back in March, 2022 the school board said the bond would increase taxes for the average taxpayer by $85.00. They gave us the figure of $2.63 per $1,000 of property value. What they missed was the double of property valuations. For this citizen, the $2.63/$1,000 would work out to be $1,409.68. When we met with Superintendent Jan Bayer, she said to disregard the March, 2022 calculations. What?

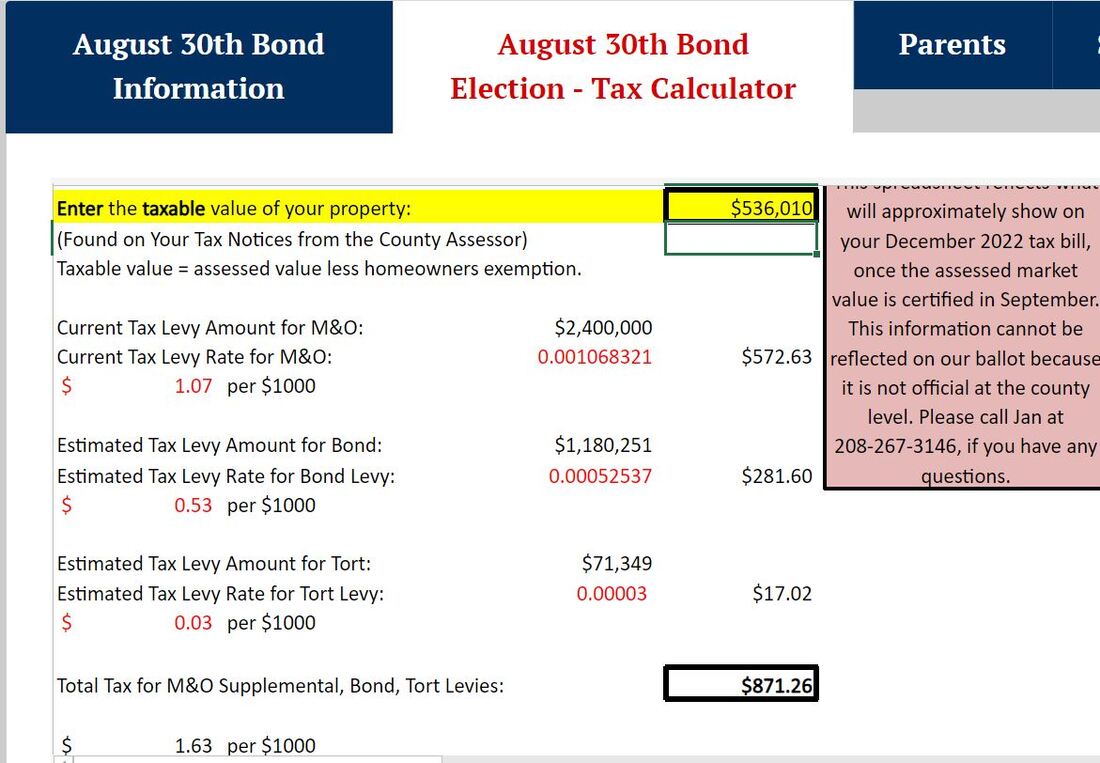

2. The school has provided the community an online calculator to figure the extra cost of the new school bond.

You'll find this calculator on the front page of the school website about halfway down the page. Click on the tab that says "Tax Calculator". In the yellow box, enter your net, new tax valuation and click enter. For this citizen the estimate for just the school bond is $281.60. Much more than the $85.00 originally touted by the school board! What was shocking to see was how the other two school taxes, school tort and the M&O Levy, increased tremendously! Why, because they are figured on the doubled tax valuations. So this citizen's tax liability for just the schools will be $871.26, up from $590.20 in 2021. This "online" calculator is figuring the school bond at $1.63/$1,000. (How it could go down a dollar per $1,000 when in March'22 the interest rate was 2.61% and now in August'22 the interest rate is 3.48% per year. How?

1. Back in March, 2022 the school board said the bond would increase taxes for the average taxpayer by $85.00. They gave us the figure of $2.63 per $1,000 of property value. What they missed was the double of property valuations. For this citizen, the $2.63/$1,000 would work out to be $1,409.68. When we met with Superintendent Jan Bayer, she said to disregard the March, 2022 calculations. What?

2. The school has provided the community an online calculator to figure the extra cost of the new school bond.

You'll find this calculator on the front page of the school website about halfway down the page. Click on the tab that says "Tax Calculator". In the yellow box, enter your net, new tax valuation and click enter. For this citizen the estimate for just the school bond is $281.60. Much more than the $85.00 originally touted by the school board! What was shocking to see was how the other two school taxes, school tort and the M&O Levy, increased tremendously! Why, because they are figured on the doubled tax valuations. So this citizen's tax liability for just the schools will be $871.26, up from $590.20 in 2021. This "online" calculator is figuring the school bond at $1.63/$1,000. (How it could go down a dollar per $1,000 when in March'22 the interest rate was 2.61% and now in August'22 the interest rate is 3.48% per year. How?

3. Lo and behold we have a third number to figure this pending school bond tax from the actual wording on the ballot! The ballot reads "$83.00 per $100,000 of taxable assessed value" (net assessment). This citizen would figure their school bond tax thus: $5.36 x $83.00 = $444.88.

CONFUSED? So are we!

Our Questions:

1. Does Valley View really need to be torn down?

2. Do taxpayers need to spend $16.4 million to fix the schools?

3. How will this increase my taxes?

The message the Boundary County School Board has put out to the community is that Valley View Elementary is in such bad shape that it needs to be torn down and rebuilt. But does it really? Not from what we've seen! (See pictures below.) Both Valley View and Mt. Hall Elementary Schools were built between 1947-1949. They are cinder block structures with flat roofs. From what we saw at both schools, the cinder block walls appeared to be in good condition. The problem is the flat roofs are causing water to pool in the basements, especially at Mt. Hall.

The second problem is the plumbing, especially the clay pipe sewer line. The line is broken in places causing unpleasant smells to whiff up in the bathrooms. Sections of galvanized water pipes also need to be replaced. Do you feel a whole building needs to be torn down to fix the roof and plumbing? We don't either.

In fact, the school district is using money from Federal ARPA/ESSR funds to replace the sewer line and plumbing at Mt. Hall as we speak. $400k of this new school bond will be used to replace Mt. Hall's roof. Why can't they do the same for Valley View? We admit it would be nice to have a new kindergarten building, on the main Valley View campus, so the children do not have to walk across the street to attend other classes. But think about it...How much does it cost to build a large new home if you already own the land? Maybe $300k? $650k? So between the roof, plumbing, and new kindergarten building, wouldn't that run less than $3 million?

Plumbing and bathroom $500k

New Pitched Roof $1.100k

New Kindergarten $400-$1m

$2.6m

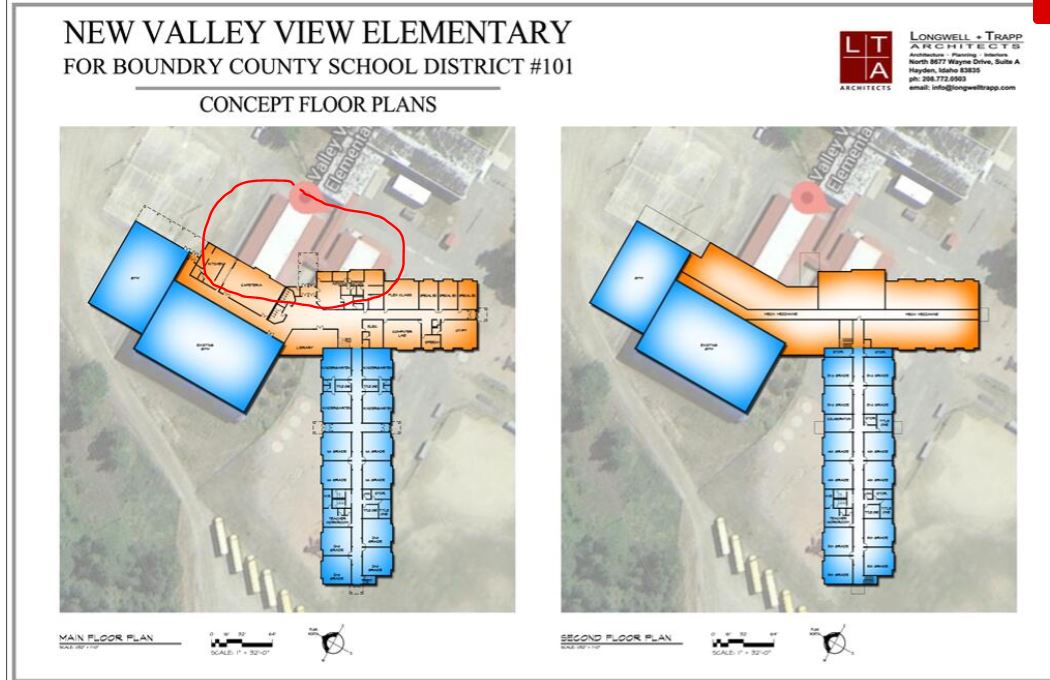

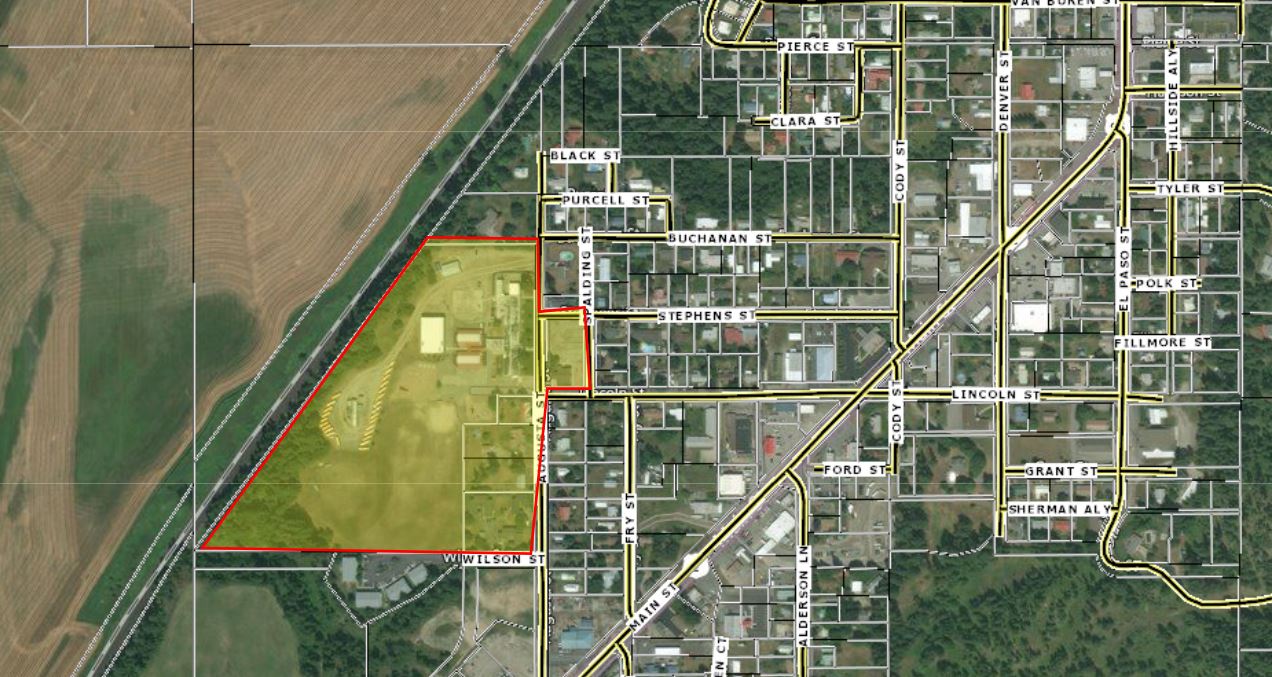

The other concern at Valley View is the drop-off and pick-up traffic flow. The School Board feels if they knock down the main building and the nice, two modular classrooms they will push back the pick-up and drop-off area further into the property. This will allow ample parking in front of the school so parents can park on school grounds. Realize, Valley View owns over 22 acres of land.

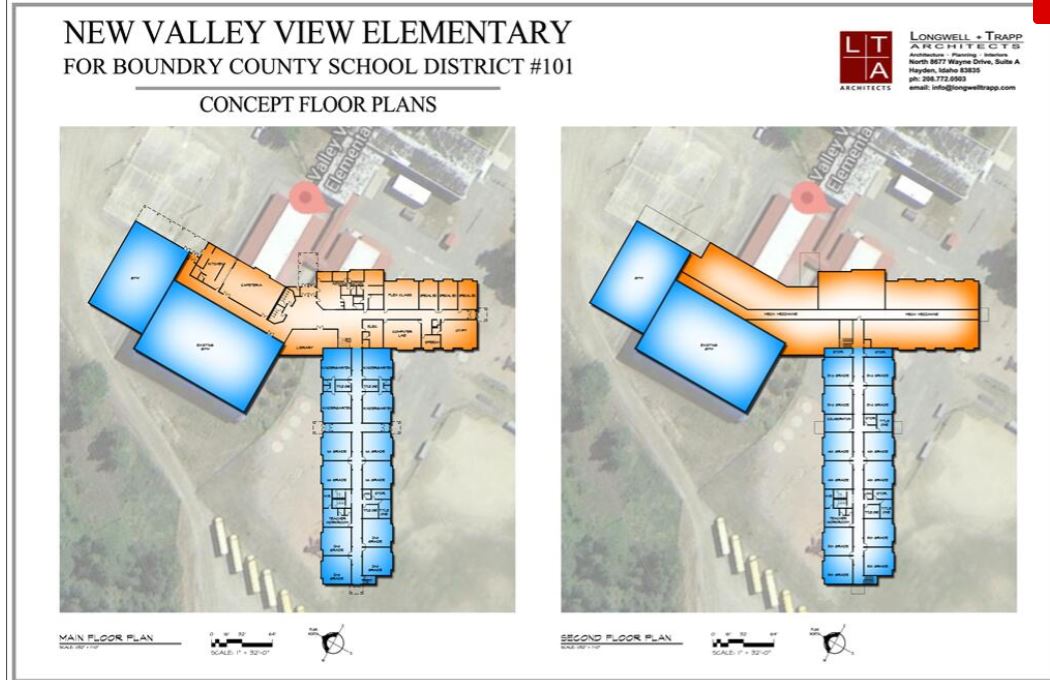

Currently, the plans for the new school show a two story building with an elevator installed on both ends of the building. The elevators will need yearly maintenance. And I question whether a two story elementary school is the safest option as I'd hate to see children pushing each other down the stairs or children slipping on the steps when they have snow on their boots.

Lastly, the School Board is budgeting for a second gym to be built: 6,200sf at a cost of $2,000,000! Yes, it's a second gym! The original gym's roof collapsed and the school built a beautiful, new gym. Now they want to build a second gym! Are you willing to foot the bill on this second gym at a cost of $2 million dollars?

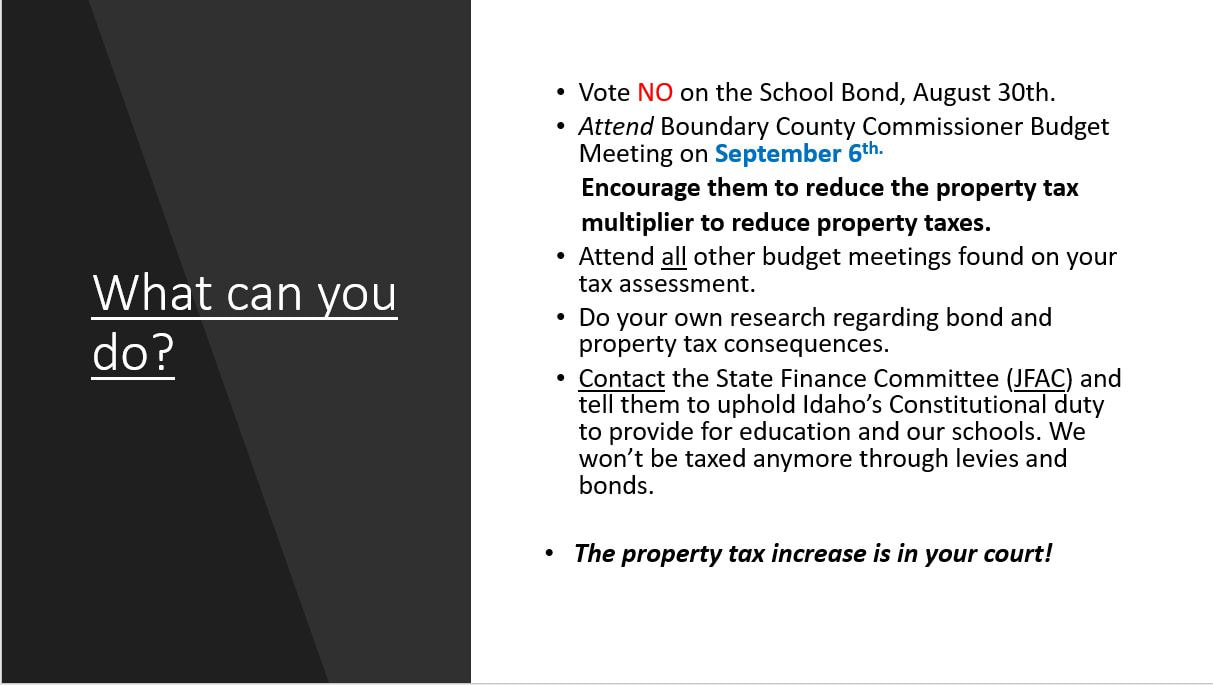

We understand the schools need repairs, but in this era of high inflation and increasing property taxes, the school needs to help taxpayers make ends meet by not burdening families with higher taxes. Please keep the repairs to a reasonable amount. We appreciate the time and effort the school staff has put into evaluating the school situation but we feel $16.4 million is overkill to get the job done. Please do your own research. We encourage you to Vote NO on the $16.4m school bond. Relieve the citizens of Boundary County. Ultimately, it's the State's responsibility to fund and repair our failing schools per the Idaho State Constitution. The local citizens should not be burdened with levies and bonds to cover a State-required service.

If this new bond is defeated, the previous high school bond has been paid off, which will reduce your taxes by that amount.

Vote No on the August 30th school bond.

Also, please attend the Sept. 6th County Commissioner Budget Meeting and let them know we will not and cannot tolerate a 50% increase in property taxes!

The second problem is the plumbing, especially the clay pipe sewer line. The line is broken in places causing unpleasant smells to whiff up in the bathrooms. Sections of galvanized water pipes also need to be replaced. Do you feel a whole building needs to be torn down to fix the roof and plumbing? We don't either.

In fact, the school district is using money from Federal ARPA/ESSR funds to replace the sewer line and plumbing at Mt. Hall as we speak. $400k of this new school bond will be used to replace Mt. Hall's roof. Why can't they do the same for Valley View? We admit it would be nice to have a new kindergarten building, on the main Valley View campus, so the children do not have to walk across the street to attend other classes. But think about it...How much does it cost to build a large new home if you already own the land? Maybe $300k? $650k? So between the roof, plumbing, and new kindergarten building, wouldn't that run less than $3 million?

Plumbing and bathroom $500k

New Pitched Roof $1.100k

New Kindergarten $400-$1m

$2.6m

The other concern at Valley View is the drop-off and pick-up traffic flow. The School Board feels if they knock down the main building and the nice, two modular classrooms they will push back the pick-up and drop-off area further into the property. This will allow ample parking in front of the school so parents can park on school grounds. Realize, Valley View owns over 22 acres of land.

Currently, the plans for the new school show a two story building with an elevator installed on both ends of the building. The elevators will need yearly maintenance. And I question whether a two story elementary school is the safest option as I'd hate to see children pushing each other down the stairs or children slipping on the steps when they have snow on their boots.

Lastly, the School Board is budgeting for a second gym to be built: 6,200sf at a cost of $2,000,000! Yes, it's a second gym! The original gym's roof collapsed and the school built a beautiful, new gym. Now they want to build a second gym! Are you willing to foot the bill on this second gym at a cost of $2 million dollars?

We understand the schools need repairs, but in this era of high inflation and increasing property taxes, the school needs to help taxpayers make ends meet by not burdening families with higher taxes. Please keep the repairs to a reasonable amount. We appreciate the time and effort the school staff has put into evaluating the school situation but we feel $16.4 million is overkill to get the job done. Please do your own research. We encourage you to Vote NO on the $16.4m school bond. Relieve the citizens of Boundary County. Ultimately, it's the State's responsibility to fund and repair our failing schools per the Idaho State Constitution. The local citizens should not be burdened with levies and bonds to cover a State-required service.

If this new bond is defeated, the previous high school bond has been paid off, which will reduce your taxes by that amount.

Vote No on the August 30th school bond.

Also, please attend the Sept. 6th County Commissioner Budget Meeting and let them know we will not and cannot tolerate a 50% increase in property taxes!

What Can you do?